Data transparency is always key, especially when it comes to sales and finance. Those who’ve spent hours syncing with accountants or chasing sales reps for invoice details know how frustrating these situations can be. Often such silos lead to errors, delays, and duplicated efforts.

An efficient way to address this is by integrating your CRM with accounting software. Take Pipedrive, a smart, sales-focused CRM, and QuickBooks, a leading accounting solution. In this blog post, we’ll explore how to integrate them, the benefits of doing so, and best practices to help you get started quickly and effectively.

Table of Contents

- Benefits of Integrating Pipedrive and QuickBooks

- What to Integrate Between Pipedrive and QuickBooks?

- Methods for Pipedrive QuickBooks Integration

- Best Practices for a Smooth Pipedrive QuickBooks Integration

- Conclusion

Benefits of Integrating Pipedrive and QuickBooks

When Pipedrive and QuickBooks work in sync, the advantages are more than obvious – they’re tangible. In a nutshell, this integration is a powerful way to increase the efficiency of your teams, leading to cleaner operations and better decision-making. Let’s take a closer look at the key points:

- Less manual data entry & errors. First and foremost, this integration frees your team from tedious manual work like re-entering customer details, payment terms, or invoice amounts. By automating these handoffs, tasks are completed faster and with greater accuracy – no more human-induced errors slowing you down.

- Streamlined sales-to-accounting workflow. A deal is marked as “Won” in Pipedrive, and an invoice is instantly created in QuickBooks. No lag, no duplicate work – just one smooth, continuous workflow where each action naturally triggers the next.

- 360-degree view of customer financials. No more frantic tab-switching or cross-referencing. With both platforms connected, teams get a shared view of customer interactions and financial status. The result? Smarter conversations and better-informed decisions – both internally and with customers.

- Improved cash flow management. The faster you invoice, the faster you get paid. Pipedrive QuickBooks integration makes one a corollary of the other, removing delays and making tracking payments easier.

- Enhanced reporting & forecasting. Bringing sales and financial data together allows you to align revenue projections with real-time performance. The result is richer, more actionable reporting – and forecasts you can actually trust.

- Better customer experience. Errors on invoices or delays in billing are a great source of customer dissatisfaction. Integration reduces these friction points, leading to faster, more accurate invoicing.

What to Integrate Between Pipedrive and QuickBooks?

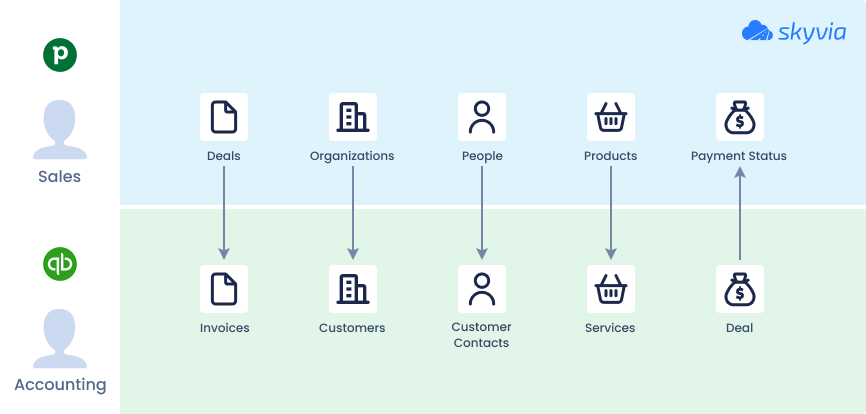

So, what are the most commonly used objects in Pipedrive QuickBooks synchronization? Let’s explore some real-world examples of popular integration scenarios and the benefits they bring:

| Integration Objects Pairs | Description | Benefits |

|---|---|---|

| Pipedrive Deals → QB Invoices / Sales Receipts | A classic trigger-action use case: when a deal is marked as “Won” in Pipedrive, an invoice or sales receipt is automatically created in QuickBooks. No delays, no manual steps. | Accelerated billing; reduced manual effort. |

| Pipedrive Organizations → QB Customers | A foundational sync with direct mapping. Whenever an organization is added or updated in Pipedrive, it’s reflected in QuickBooks for accurate invoicing and reporting. | Data consistency across platforms. |

| Pipedrive People → QB Customer Contacts | Syncing Pipedrive contacts to QuickBooks Customer Contacts helps you build a reliable link and never miss the right person in communication. | Verified communication channel; accurate invoicing. |

| Pipedrive Products → QB Products / Services | Even the smartest accounting system can’t invoice for items it doesn’t know. Syncing product catalogs between platforms ensures that line items match exactly. | Aligned product catalog; accurate invoicing. |

| QB Payment Status → Pipedrive Deal (custom field or note) | QuickBooks tracks payments and invoice statuses; syncing this data back to Pipedrive keeps sales teams informed and ready to take the required follow-up action. Note: This integration is possible only with tools that allow custom field mapping and conditional logic, like Skyvia or Make. | Up-to-date payment statuses. |

Methods for Pipedrive QuickBooks Integration

Method 1. Native Integration

As software adoption goes hand in hand with its connectability, vendors invest in making their products more integrable. Native integration refers to prebuilt apps developed and endorsed by a software vendor to enable plug-in connectivity with other systems.

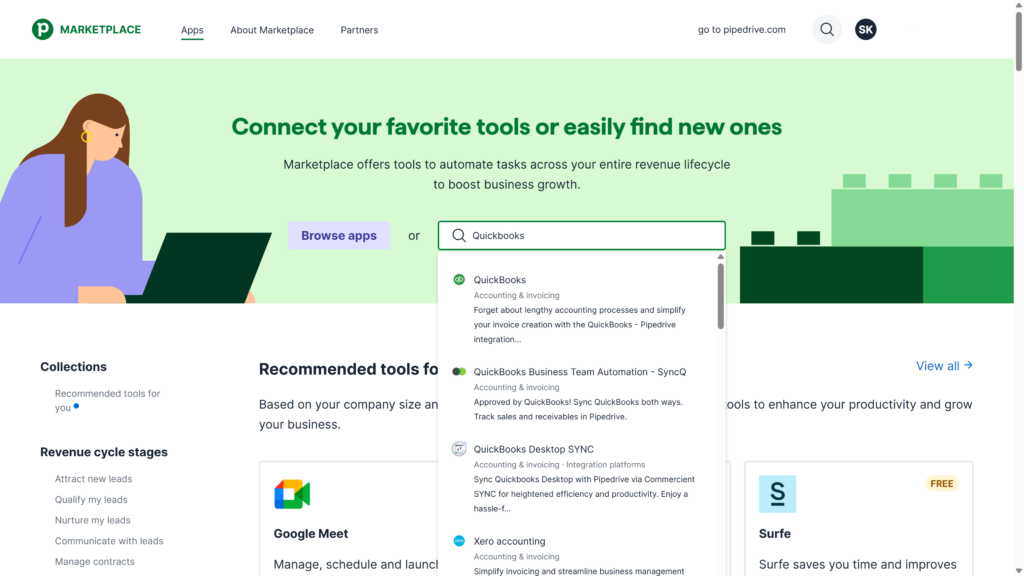

Pipedrive supports over 400 such integrations, including QuickBooks, which is available as a connector app in the Pipedrive Marketplace.

Best for

- Small to mid-sized businesses looking for a quick and easy setup.

- Users with minimal technical expertise.

- Basic syncing needs (e.g., deals to invoices, contact matching).

- Teams who prefer UI-based configuration over coding or custom workflows.

Step-by-step Guide

- Log in to your Pipedrive account. You must have the necessary admin rights to install apps.

- Access the Pipedrive Marketplace: use the direct link or click on the profile icon and select Tools and apps → Marketplace.

- Search for QuickBooks-related apps.

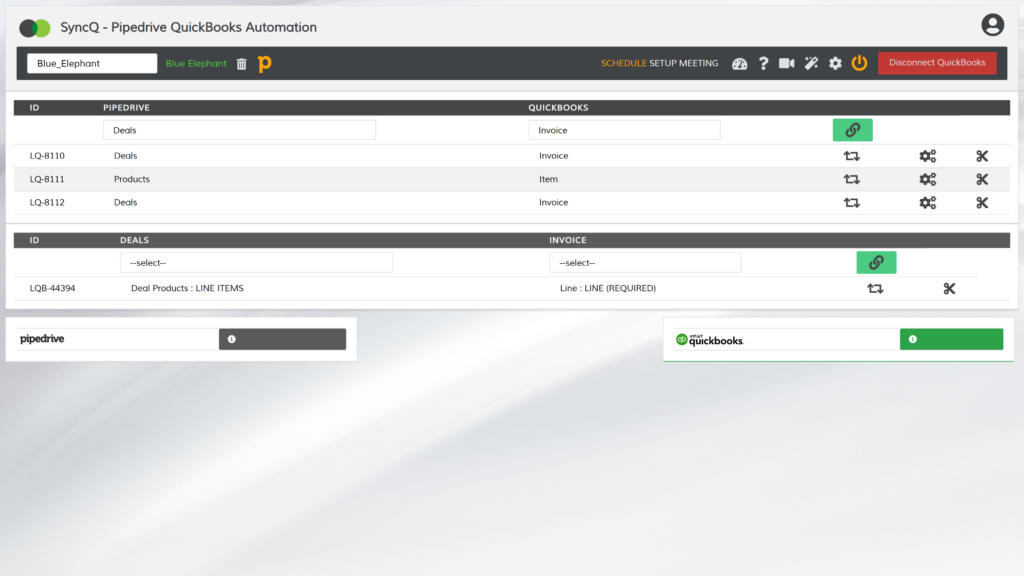

- Follow the installation prompts to install the connector app. For this example, we’ll use SyncQ, a Pipedrive – QuickBooks automation tool.

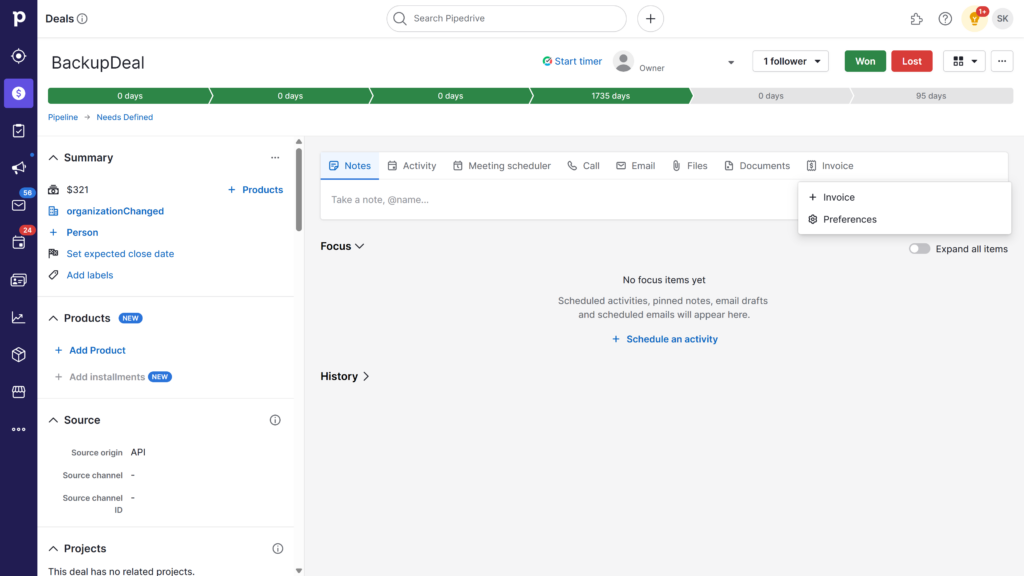

- Connect your QuickBooks account: log in to QuickBooks and grant the required permissions for the connector to access your customer, invoice, and product data. Once the application is installed, the invoicing feature becomes available directly within your Pipedrive interface.

- Define what you want to sync:

Note: Configure invoicing preferences in Pipedrive to have the data entered here automatically synced with your QuickBooks account. Some apps also let you specify trigger events, such as syncing when a new contact is added or a deal stage changes.

Pros

- Quick deployment with guided setup.

- Easy to use as a no-code solution.

- Official support and plenty of documentation.

Cons

- Support for QuickBooks Online only; integration with QuickBooks Desktop requires third-party solutions.

- Not suitable for custom workflows because of predefined sync logic.

- Object mapping is limited to basic objects only.

- Possible vendor lock-in because of lack of transparency under the hood.

Method 2. Point-to-Point Connector Tools

Point-to-point solutions, also known as workflow automation platforms, offer a fast and simple way to connect two systems. They operate on an event-based basis, where one system triggers a defined action in another – hence the name point-to-point.

Although automation platforms lack full capabilities of true ETL tools – like bulk transformations, advanced mapping, or scheduling – they handle their narrow-defined tasks diligently and reliably. Examples of point-to-point solutions include Zapier, Make, Tray.io, IFTTT, Integrately, and others.

Best for

- Small businesses with limited technical resources.

- Simple cases of trigger-action or event-response workflows.

- Lightweight automation scenarios between two apps.

Step-by-step Guide

Let’s walk through creating a workflow in Zapier that automatically generates a QuickBooks invoice each time a deal is marked as “Won” in Pipedrive.

- Log in to Zapier.

- Сlick Create in the dashboard to start a new zap (automation).

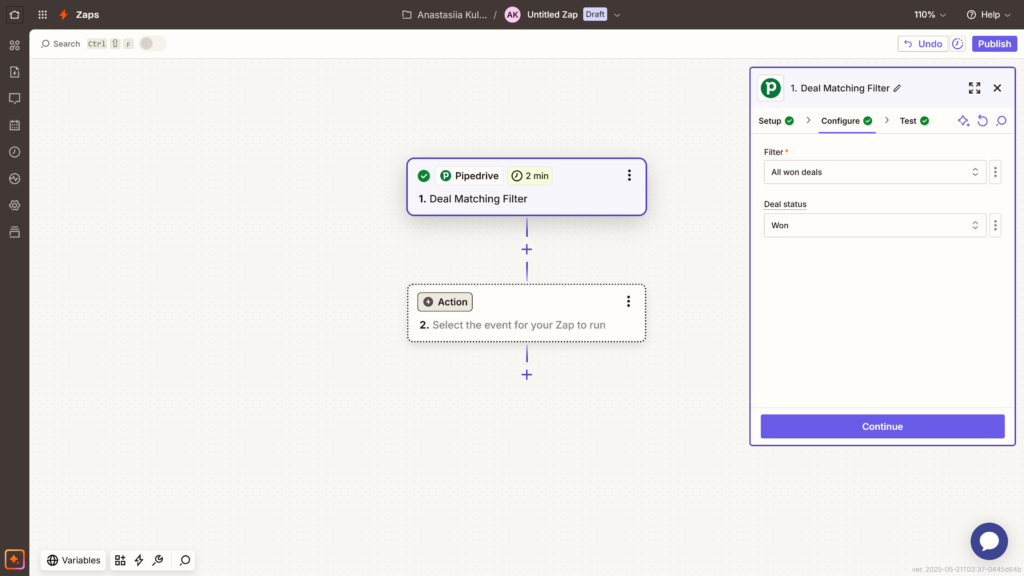

- Set up the trigger:

- Choose Pipedrive as the source application.

- Set the trigger event as Deal Matching Filter.

- Connect your Pipedrive account and authorize access.

- Choose the pipeline and filter deals marked as “Won”.

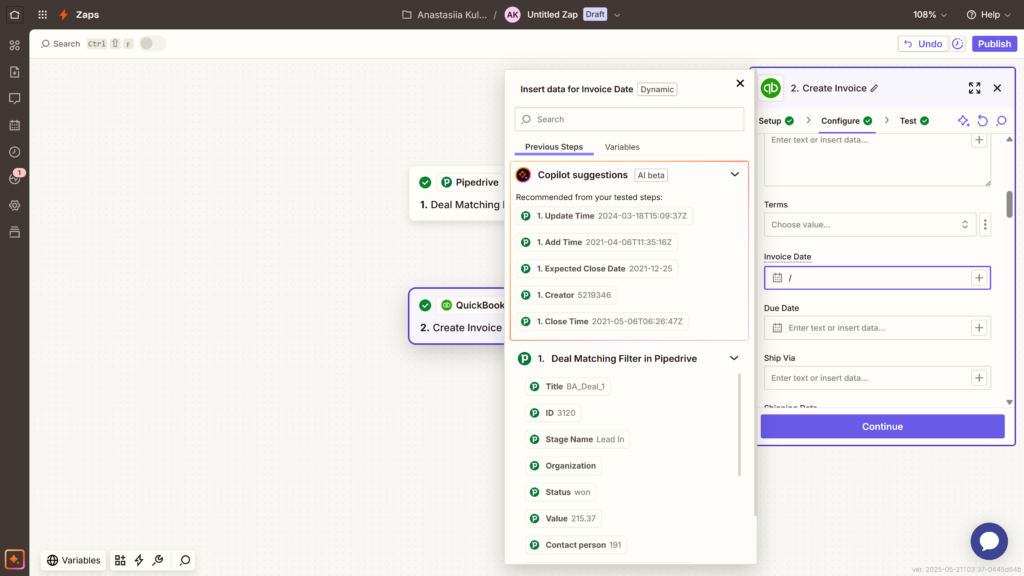

- Set up the action:

- Choose QuickBooks Online as the target app.

- Set the required action event, e.g., create an invoice.

- Connect your QuickBooks Online account and authorize access.

- On the Configure tab, specify invoice details by mapping fields from the Pipedrive trigger.

- Test to ensure the automation runs as expected.

- If successful, click Publish to activate it.

Pros

- Quick setup with visual workflows.

- No-code, drag-and-drop interface.

- Wide application support.

- Real-time triggers.

Cons

- Not suitable for multi-step workflows or large data volumes.

- Allows for connecting only two systems at a time.

- No deep data mapping.

- Pricing escalation with usage volume.

Method 3. Dedicated Data Integration Platforms

Unlike point-to-point automation tools, dedicated data integration platforms (iPaaS) provide a more advanced and scalable approach. Their capabilities go well beyond basic connectivity or simple rule-based automations. With features like scheduling, multi-object mapping, and support for custom logic, these platforms offer full control over how and when data moves between systems.

The growing integration needs of modern businesses make iPaaS solutions more in demand than ever. Popular platforms include SnapLogic, Workato, Boomi, MuleSoft, Skyvia, and others. While they differ in data handling, automation features, and pricing models, most of them offer a common core set of capabilities:

- A library of pre-built connectors to various data sources.

- Intuitive, no-code UI.

- Tools for building, scheduling, and monitoring of integration workflows.

- Support for data mapping and transformations.

- Cloud-based scalability.

Best for

- Mid-sized to large businesses with evolving integration needs.

- Non-technical users who need powerful capabilities without relying on engineering.

- Cases of high-volume data exchange across sales and finance systems.

Why Use Skyvia for Pipedrive & QuickBooks Integration?

Skyvia is a comprehensive data integration platform built to automate a variety of data integration tasks, including ETL, ELT, reverse ETL, data migration, and both one-way and bi-directional synchronization. Alongside the core iPaaS features outlined above, Skyvia has its strengths that set it apart from the competition:

- Support for multiple data sources: beyond straightforward Pipedrive-QuickBooks integration, Skyvia lets you weave these tools into broader workflows involving CRMs, marketing platforms, databases, and cloud storage services.

- Data backup and recovery: the platform offers automated daily backups and easy data restoration options, safeguarding against data loss.

- Customizable workflows: with the support of wizard-based and visual design tools, Skyvia provides the flexibility to create complex multi-step workflows aligned with specific business scenarios.

- Scalability: from small start-ups to large enterprises, the platform scales with your business, efficiently handling growing amounts of data.

Last but not least, Skyvia supports integrations with both QuickBooks Online and QuickBooks Desktop, providing dedicated connectors for each. In the next section, we’ll show how to synchronize data from the QuickBooks SalesReceipt object to Pipedrive Deals in just a few clicks.

Step-by-step Guide

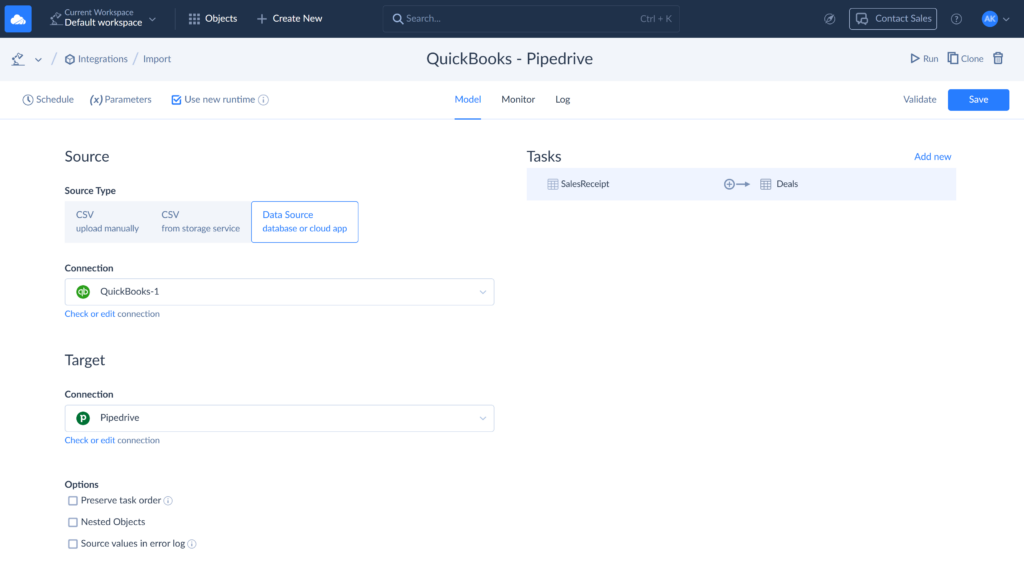

- Log in to your Skyvia Account.

- Create connections to both QuickBooks and Pipedrive as described in the documentation. In this example, we’re connecting to QuickBooks Online, a SaaS-based solution.

Note: Connecting to QuickBooks Desktop requires installing the Skyvia Agent on your local machine.

- In the top menu, click Create New and select Import.

- Set the source type to database or cloud App.

- Select your QuickBooks connection as the Source and your Pipedrive connection as the Target.

- Click Add new to create an import task.

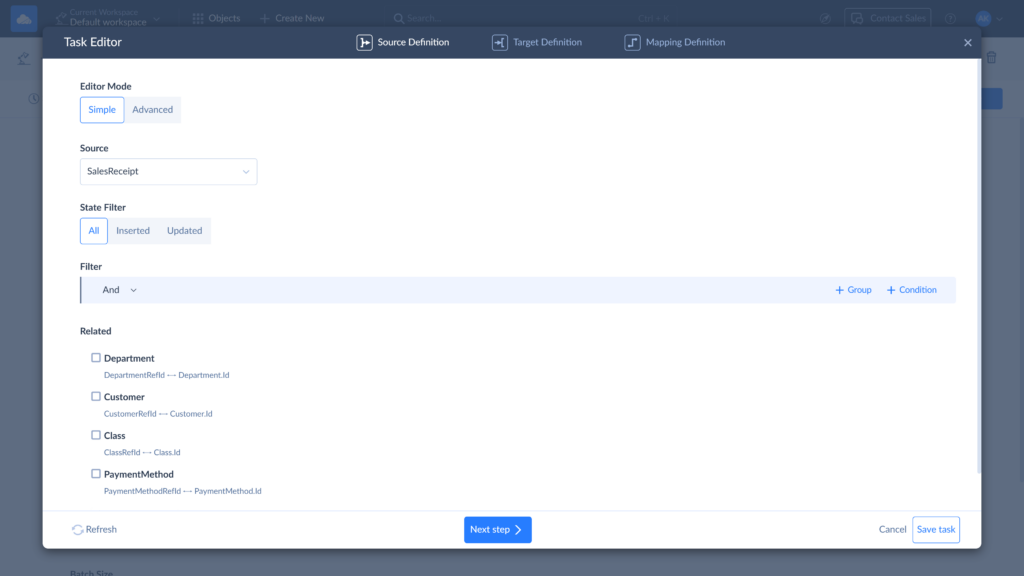

- In the Task Editor, configure your Source settings: сhoose the object you want to import data from (e.g., SalesReceipt). Apply filters if needed.

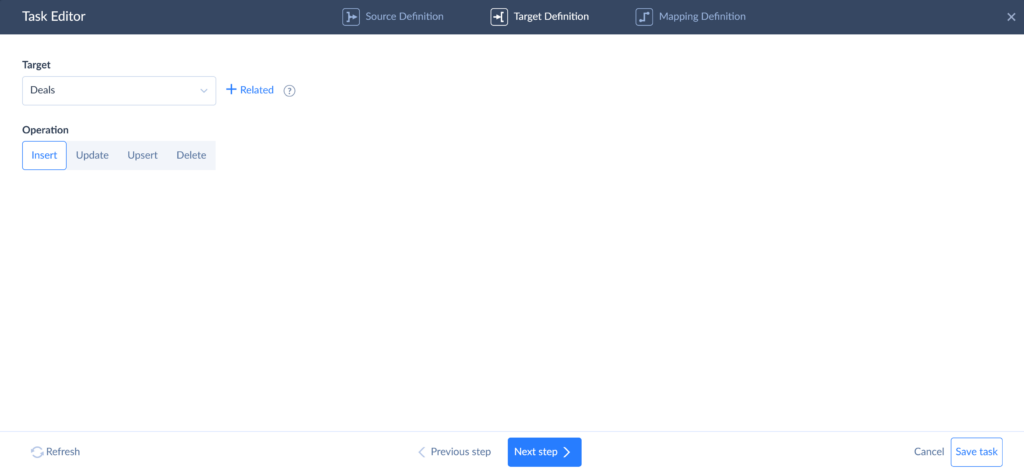

- In the Target settings, select the destination object in Pipedrive (e.g., Deals), and choose the desired operation (e.g., Insert or Upsert).

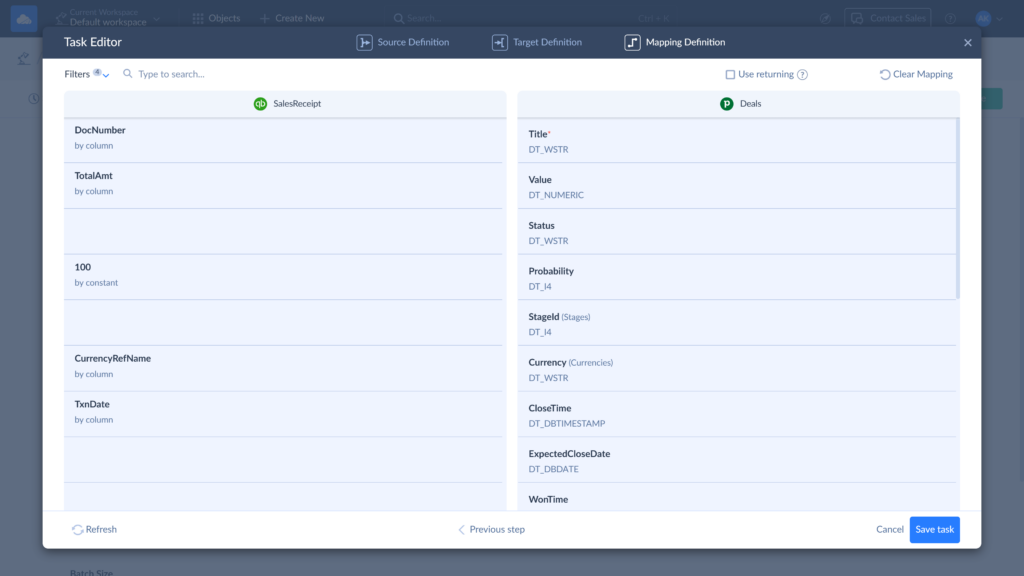

- On the Mapping Definition page, map source columns to target fields. Fields marked with an asterisk are required to create a valid task.

Note: For this integration, the Title field is required on the Pipedrive side. It identifies the deal with a short description or label. When importing from QuickBooks SalesReceipt, map Title to any identifying field that gives the deal context, such as DocNumber or CustomerRefName.

- Save the task and run the integration.

- Click the Schedule tab to set up automatic execution at your preferred intervals.

- Monitor integration progress on the Monitor or Logs tabs.

Pros

- Advanced automation options with support for multi-step workflows, conditional logic, triggers, and scheduling.

- Scalability to handle growing data volumes without performance degradation.

- Bi-directional synchronization.

- Extensive mapping & transformation options.

- Multi-system integration in a unified data workflow.

- No-Code/low-code setup.

Cons

- Learning curve when configuring logic-based flows and mappings.

- Can be an overhead for simple one-to-one syncs.

- Pricing can be too high for companies with limited budgets.

Best Practices for a Smooth Pipedrive QuickBooks Integration

- Define your integration goals. Naturally, if you decide to integrate Pipedrive with QuickBooks, you probably know what data should be synced and under what conditions. Define clearly the objects for integrations, such as invoices, contacts, or both, and the triggers that should launch the workflow.

- Clean your data before integrating. Integration is a step toward optimization, and there’s no point in optimizing messy data. Before launching the sync, make sure the data in both systems is accurate and standardized. Remove duplicates, fill in missing key fields, and review naming conventions. Remember: garbage in, garbage out.

- Start simple, then scale. Begin with one essential use case before layering in more complexity. This reduces risk and makes troubleshooting much easier.

- Understand data mapping requirements. Mapping holds the key to the success of the whole operation. It ensures accurate data transfer, and poor mapping can stop your integration in its tracks. Pay attention to field compatibility, data types, and required fields on both sides.

- Test thoroughly. Even if you’re not a first-timer, a test run is always worth it. It helps you catch potential issues like missing fields or currency mismatches – things that can derail your workflow. At best, it gives you peace of mind. At worst, it saves your integration from failing unexpectedly.

- Monitor your integration regularly. Keep an eye on sync logs, error messages, and performance over time. Most integration platforms offer logs or alerts – use them to proactively catch and fix issues.

- Involve both sales and accounting teams. This integration exists to support both sales and accounting, but their priorities are different. Sales might care about deal stages and contacts, while accounting focuses on billing details and tax codes. Make sure both teams have input when building the workflow.

- Plan for QuickBooks Online vs. Desktop differences. As mentioned earlier, some integration tools only support QuickBooks Online, while others (like Skyvia) support both. Be sure your chosen solution matches the version of QuickBooks you use – the data structures and connection methods are different.

- Document your integration setup. Keep a clear record of how the integration is configured – triggers, field mappings, error-handling rules, and access credentials. This is a lifesaver when updating the flow or handing it off to someone else.

- Review and update as processes evolve. As your business grows, so do the workflows and data you rely on. New fields may fall through the cracks if not included in the workflow. Review your integration regularly to ensure it keeps up with your current processes, not last quarter’s setup.

Conclusion

If a minus times a minus equals a plus, then combining two pluses doubles the benefit. That’s exactly what you get with Pipedrive-QuickBooks integration – a classic CRM-accounting sync setup that helps eliminate mismatched records, invoice discrepancies, and the delays caused by manual data entry.

In this article, we explored three integration methods:

- Connector applications for basic sync scenarios.

- Point-to-point automation tools for simple, event-driven tasks.

- Integration platforms for handling large data volumes, complex mappings, and multi-entity workflows.

Choose the method that best fits your business size, scalability needs, and team’s technical comfort level. And whichever path you take, remember that starting with Skyvia is both effortless and cost-effective.

F.A.Q. for Pipedrive and QuickBooks Integration

Can I sync custom fields from Pipedrive to QuickBooks using an integration tool?

Yes, many integration tools like Skyvia support custom field mapping, allowing you to sync non-standard fields based on your specific business needs.

How often can data be synced between Pipedrive and QuickBooks?

It depends on the tool. Some support real-time sync, while others offer scheduled syncs at custom intervals – hourly, daily, or on-demand.

Is it possible to integrate Pipedrive with QuickBooks Desktop, or only QuickBooks Online?

Yes, some tools like Skyvia support both QuickBooks Online and Desktop. Just note that QuickBooks Desktop integration may require installing a local agent.